Articles

- Worksheet, Line 1, Orders Subject to Have fun with Taxation

- Federal mediocre rates of interest to own Cds

- Stating reimburse otherwise costs produced for the exclusive go back when amending your own income tax get back:

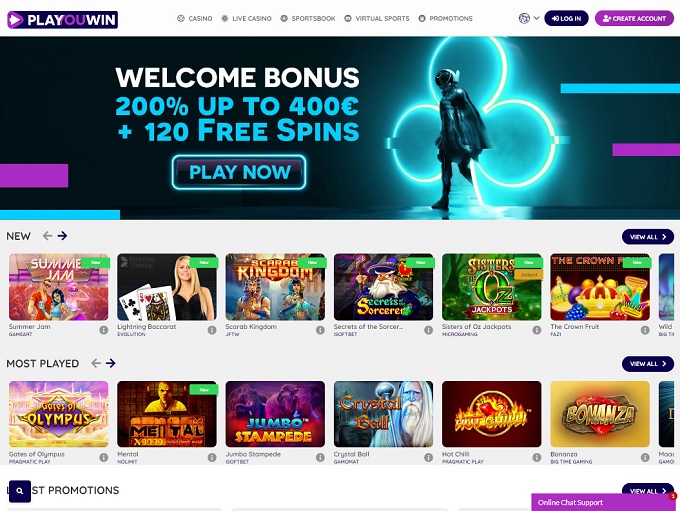

- Create all the way down deposit casinos on the internet provide position online game?

- Exactly what are local casino no-deposit incentives?

Rather, fool around with unmarried, married/RDP submitting on their own, or qualifying surviving companion/RDP submitting condition, any applies to you. For individuals who submitted a revised come back on the Irs with this issue, you have got couple of years so you can document your own amended Ca go back. No-rates or Lower-prices Medical care Publicity Advice – To possess taxable decades birth to the otherwise after January 1, 2023, i added an alternative medical care coverage advice matter on the tax go back. If you are searching for no-prices otherwise reduced-prices health care publicity guidance, look at the “Yes” box to the Form 540NR, Top 5. See certain line guidelines to own Mode 540NR, Medical care Coverage Advice area. Married/RDP Filing As you to Married/RDP Filing Individually – You can not change from partnered/RDP processing as you so you can hitched/RDP filing independently pursuing the due date of the tax get back.

The present day you to definitely-half of inclusion price as well as relates to money losings. It financial, as its identity implies, is amongst the earliest on line banking institutions, created in 1999. Their full name try Basic Websites Lender away from Indiana, even though the bank operates all over the country. The financial institution’s Video game prices is constantly aggressive to have quick and you will a lot of time Computer game terminology.

- As well as go into “Repaid” and the amount you paid back on the dotted line next to line 7.

- Notifications out of a great child’s passing also are wanted to the fresh CRA by the provincial/territorial essential analytics companies.

- The applying enabling the reimburse getting transferred to your TreasuryDirect account to shop for offers securities, plus the capacity to purchase papers bonds with your reimburse, could have been deserted.

- On the Irs.gov, you can purchase upwards-to-go out information about current events and you can changes in taxation rules.

- For those who produced energy efficient developments to 1 or maybe more house which you made use of because the a house throughout the 2024, you happen to be capable make the home-based brush energy credit.

Usually do not file Form 8862 for individuals who registered Setting 8862 to own 2023 plus the kid taxation borrowing, more son taxation credit, otherwise credit for other dependents try welcome for this 12 months. This should be shown inside field 4 of Function 1099, container 6 from Form SSA-1099, or field 10 from Function RRB-1099. Don’t file Function 8862 for those who submitted Form 8862 to have 2023, and also the kid taxation borrowing from the bank, extra boy income tax borrowing, or credit with other dependents try welcome for the seasons. The brand new premium is going to be for visibility for you, your wife, or dependents.

Worksheet, Line 1, Orders Subject to Have fun with Taxation

And then make a tiny put from the a new gambling establishment allows people in order to have system unlike risking a good deal of money. Participants are able to see exactly what the gambling enterprise now offers, like the band of games, advertisements, and system. Taxpayers have the right to predict the brand new tax program to take on items and points which may affect their underlying liabilities, ability to shell out, otherwise ability to offer guidance punctual. Taxpayers have the straight to found assistance from the newest Taxpayer Suggest Services if they are experience monetary difficulty or if perhaps the newest Irs hasn’t solved the income tax points securely and you will prompt with the regular streams. Taxpayers have the right to expect you to any suggestions they provide to your Internal revenue service will not be uncovered until authorized by the taxpayer or by-law.

Go to TreasuryDirect.gov/Research-Center/FAQ-IRS-Tax-Function. For those who gotten electronic assets as the ordinary income, and therefore income is not said in other places on your own go back, happy-gambler.com click resources you are going to get into those individuals quantity to your Plan step 1, range 8v. If you owe solution lowest income tax (AMT) otherwise want to make an excess progress advanced taxation borrowing from the bank fees.

Our very own point would be to focus on banks anyone all over the country is also play with, but i don’t program profile one demand high balance minimums so you can either unlock otherwise care for an account. Lowest deposit standards out of 10,one hundred thousand or even more affected ratings negatively, while the did highest minimal balance conditions to prevent charges. Maybe needless to say, the top concern is high rates. I used the newest survey’s brings about produce the methods we used to price various from offers profile.

Federal mediocre rates of interest to own Cds

You may either afford the premium on your own otherwise your own relationship is outlay cash and you may declaration her or him while the secured costs. In case your coverage is in the identity and you also pay the premiums oneself, the connection need refund you and report the newest premiums as the guaranteed costs. Certified costs are amounts repaid otherwise incurred within the 2024 for personal defensive gizmos, disinfectant, and other offers useful for the newest protection of the give of coronavirus. Go into the quantity of your foreign gained earnings and homes exclusion from Function 2555, range forty five.

Is always to a great provincial otherwise territorial Top firm stating the newest taxation credit not report per year about precisely how the fresh tax borrowing from the bank features enhanced ratepayers’ debts, a penalty was recharged to that Top firm. Yet not, several income tax credits will be available for the same enterprise, to the the amount that the venture includes expenditures eligible for some other tax credits. The fresh Brush Strength funding income tax borrowing from the bank was subject to possible payment loans just as the recapture legislation proposed to the Clean Technology financing taxation borrowing from the bank. Beneath the latest legislation without a doubt services explained inside Classification 43.1 otherwise 43.dos, all the standards for introduction from the Group should be met for the an annual basis. There’s a limited exception regarding the Taxation Legislation to own assets that is element of a qualified system which had been before run in the a great being qualified fashion.

Matthew is actually a senior individual financial reporter with well over a few ages of journalism and you may monetary features possibilities, permitting subscribers create advised behavior regarding their individual finance needs. His financial career boasts becoming a great banker inside Nyc and you may a financial manager in the among the nation’s biggest banking institutions. Matthew is currently an associate of your own Panel out of Governors from the the fresh People for Advancing Business Editing and you may Writing (SABEW), chairing their knowledge representative involvement panel which is co-settee of its Financing Committee. This can be an interest-impact account offered by each other banks and you can borrowing from the bank unions which is just like a checking account plus also offers certain savings account have. United states of advantages has checked out of numerous 5 minimal put Australian gambling enterprises to include the magic have. Get the full story, and we will help you create the top to the membership of one’s new searching the whole directory of guidance your’lso are looking for.

Stating reimburse otherwise costs produced for the exclusive go back when amending your own income tax get back:

With an internet membership, you can access a variety of information so you can while in the the brand new submitting 12 months. You should buy an excellent transcript, comment your most recently recorded income tax come back, and possess your own modified gross income. Generally, to quick allege a reimbursement on the amended return, Setting 1040-X should be recorded within 3 years following time the brand new new go back are recorded otherwise within a couple of years following go out the newest tax try paid off, any type of try after. However you may have more time to help you file Form 1040-X if you’re within the a great federally announced disaster town or you are individually otherwise emotionally incapable of control your economic things. Failure to include an provided Internet protocol address PIN for the digital go back will result in an invalid trademark and a rejected return.

Create all the way down deposit casinos on the internet provide position online game?

RDPs, make use of your recalculated federal AGI to work the itemized deductions. For those who have a foreign address, stick to the country’s habit to possess going into the city, state, province, county, nation, and you may postal password, since the appropriate, on the suitable packages. To find out more, go to ftb.california.gov and search for disclosure obligation.

Fully taxable retirement benefits and you can annuities likewise incorporate armed forces later years pay found for the Function 1099-Roentgen. You may need to spend an additional tax for many who gotten an early on shipment from your own IRA plus the complete was not rolled over. See the recommendations to have Plan 2, line 8, to have details. Desire credited inside the 2024 on the dumps that you didn’t withdraw because the of the personal bankruptcy or insolvency of the lender may well not should be included in your 2024 money.

Exactly what are local casino no-deposit incentives?

For those who meet up with the modified gross income demands, you happen to be able to utilize 100 percent free tax thinking application in order to prepare yourself and you will age-document your tax go back. Check out Internal revenue service.gov/FreeFile to see if you meet the requirements as well as for considerably more details, along with a summary of 100 percent free Document top people. For many who acquired nontaxable Medicaid waiver repayments, those individuals numbers would be to now be said to you on the Mode(s) W-dos inside the box several, Code II.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/A2VDPDA3GZHPBFMCNCHLWCOSNA)